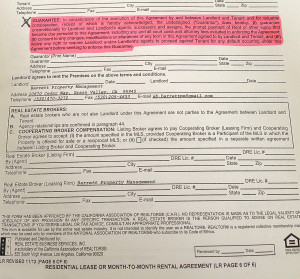

What is a guarantor in a lease agreement? Some people may be more familiar with the term “co-signer”. Simply put, the guarantor or co-signer is a 3rd party to a rental or lease agreement. They “guarantee” the payment of rent, or any other sum of money that may become due pursuant to the rental or lease agreement.

Here in the foothills of Northern California, guarantors are not that uncommon. A few of the main reasons a Grass Valley property manager or landlord may require a tenant to secure a guarantor or co-signer are:

- If the tenant has an undesirable credit score or negative factors on their credit report.

- If the tenant’s income is not sufficient to meet the basic screening requirements. You can view Barrett Property Management’s tenant screening requirements HERE. Each property management company has their own guidelines.

- If the tenant has undesirable rental history.

At Barrett Property Management Nevada City, we require that a guarantor’s income be equal to or greater than 5 times the rental rate. A credit score of 750+ is also desired. When you hire the best Nevada City property management team, you get the best results. Call Barrett Property Management company today! We also service Grass Valley, Auburn, and Colfax.

The article What is a Lease Guarantor? by ApartmentRatings.com goes into more detial about what a guarantor is, how they are arranged, and reasons for adding a guarantor.